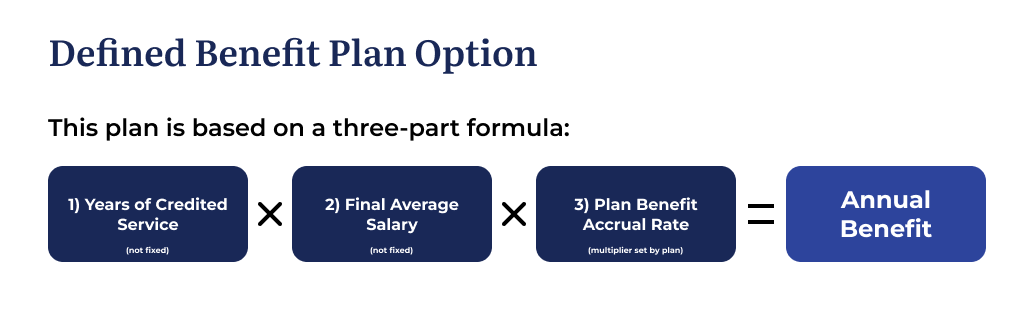

Flowchart detailing the calculation for a Defined Benefit Plan Option. The Annual Benefit is calculated using a three-part formula: 1) Years of Credited Service multiplied by 2) Final Average Salary multiplied by 3) Plan Benefit Accrual Rate equals Annual Benefit.

Defined Benefit (DB) plans are considered “traditional pension” plans. Employee retirement payments are based on a pre-set formula and takes into account:

- Years of credited service

- Final average salary

- The plan benefit accrual rate (multiplier) determined by your employer

For Example: 10 (years of credited service) x $30,000 (final average salary) x .05 (accrual rate/multiplier) = $15,000 (annual pension benefit).

Depending on the plan chosen by your employer, you may be required to make contributions to assist with funding their retirement benefit.

How is a Defined Benefit plan funded?

- Employer contributions

- Employee contributions

- Earnings on investments